The State Pension

Useful information about the State Pension, including how it works with your other pensions and how to apply for it.

Select the specific topics below to learn more about the State Pension and how it works alongside your Scheme benefits.

The State Pension is a payment from the government, based on your National Insurance contributions or credits.

The State Pension is separate to the pension you have with the BTP Fund and any other pensions you may have.

To receive your State Pension, you’ll need to claim it from the government once you reach your State Pension Age (SPA).

Your SPA will usually be later than your Normal Retirement Age (NRA) in the Fund.

You can check your State Pension age at gov.uk/state-pension-age. You can find out more about your NRA in your Scheme Member Guide. This can be found when you log in to your myFund account.

If you don’t want to claim your State Pension once you reach your SPA, you can take it later. Your State Pension will automatically defer until you claim it, so you can take it when you’re ready. You can find out more about deferring your State Pension on the government website.

Once you have claimed your State Pension, it will be paid to you every 4 weeks. This will be a separate payment to any other pensions you receive.

From 6 April 2016, the government replaced the basic State Pension and the additional State Pension with the new State Pension for people reaching SPA from that date.

You’ll be eligible for the new State Pension if you are:

If you were born before these dates, you’ll need to claim the basic State Pension instead. The new State Pension is paid as a single-tier amount.

If you qualify for the new State Pension, you will not be eligible for the additional State Pension. That option is only available to those who are eligible for the basic State Pension.

You can find more information about the new, basic and additional State Pension on the government website.

The amount of State Pension you’ll be able to get will depend on your National Insurance record.

If you reached State Pension age (SPA) before 6 April 2016, there will be no change to the State Pension that you are eligible to receive from the government.

However, if your SPA is after 5 April 2016, you will need to claim the new State Pension.

The full new single-tier State Pension for 2024/25 is currently £221.20 per week.

If you did not make any National Insurance contributions, or received any National Insurance credits before 6 April 2016, the amount of State Pension you will be eligible to receive will be calculated by the government on the new State Pension rules.

You must have at least 10 ‘qualifying’ years of National Insurance contributions to be eligible to receive any of the new single-tier State Pension. To receive the full amount of the new State Pension, you will need 35 years of full ‘qualifying’ National Insurance contributions. For more information on what defines a qualifying year, go to the government website gov.uk/new-state-pension.

If you made National Insurance contributions, or received National Insurance credits before 6 April 2016, the National Insurance record you built up will be used by the government to calculate a ‘starting amount’.

The starting amount is part of the new State Pension, and it may be more or less than the full amount.

If your starting amount is less than the full amount, you may be able to add more qualifying years to your National Insurance record. If your starting amount is more than the full amount, it is called your ‘protected payment’. It is more than the new State Pension as your protected payment is paid on top of the full new State Pension.

If you were a member of the BTPFSF, or another contracted out scheme before 6 April 2016, you were previously contracted out of the additional State Pension. This means that even if you have paid National Insurance contributions for 35 years, your new State Pension ‘starting amount’ may be less than the full amount. This is to reflect the years you were contracted out, and paid a reduced rate of National Insurance contributions.

If you continued to pay National Insurance contributions after 6 April 2016, and had less than 35 ‘qualifying’ years, you will have added to any starting amount. This may have increased the new State Pension you will be eligible to receive, up to the full entitlement. You will get £5.82 per week (£203.85 ÷ 35) towards your new State Pension for each additional ‘qualifying’ year you work, until you have the full amount. To fill in any gaps in your National Insurance record, you may decide to pay additional voluntary contributions.

You can find out more information about the State Pension, and see how your National Insurance contributions are valued by the government at gov.uk. You can also check your State Pension forecast, and see if you are eligible to receive the full amount.

Your forecast will tell you your SPA, and give you an estimate of what you can expect to receive. This is a helpful planning tool.

Your State Pension forecast may also show your estimated Contracted Out Pension Equivalent (COPE) amount.

The estimated COPE amount on your State Pension forecast indicates the amount that would have been deducted from the additional State Pension which existed before the new State Pension was introduced in 2016.

The COPE amount is not deducted from the new State Pension amount you’ll receive. However, the government may provide the estimated COPE amount to you, simply to let you know that for a period of time, you were contracted-out of the pre-2016 State Pension arrangements and paid lower National Insurance (NI) contributions. This was, in effect, a form of tax relief. You paid less tax during a period as you were contributing to your Fund pension.

The benefits you receive from the BTP Fund have already taken this into account, so there is nothing further you need to do and nothing additional to claim.

You can find out more about COPE and contracting out at gov.uk.

Income from your State Pension is taxable, but is usually paid before any tax is taken.

You receive it gross, this means no tax is taken before it is paid to you.

You pay Income Tax when your total annual income is above your Personal Allowance.

The standard Personal Allowance is currently £12,570, you can check your Personal Allowance at gov.uk.

You pay tax on your total annual income from all sources, including:

Although Income Tax is not taken directly from your State Pension, this will use up some of your tax-free Personal Allowance. You may want to contact HMRC to determine the tax implications when you receive your State Pension to avoid a tax bill at the end of the tax year.

If you need more information about your Personal Allowance and the tax you may need to pay, you will need to contact HMRC.

You can also find out more information at MoneyHelper.org.uk

You can take your Fund benefits before claiming your State Pension.

Your Normal Retirement Age (NRA) in the Fund is usually earlier than your State Pension age (SPA).

You may also be able to apply to take your Fund benefits before you reach your NRA. If you’re unsure of your NRA, you can check it by logging in to your myFund account.

You may have the option to take a higher pension from the Fund before you claim the State Pension. With this option, your Fund pension would reduce after you reach your SPA. This is known as the flexible pension option. You can read more on the ways to take my pension page.

You can also request an estimate of your Fund pension in your myFund account.

This may be possible for some members.

You may be able to take your Fund benefits after you have claimed your State Pension if you are still working and haven’t taken your Fund pension and your section’s rules allow.

To work out what your total income is likely to be in retirement you will need to find out what your State Pension entitlement is likely to be, and add that to any other sources of income such as your Fund pension.

You can find out how to work out your likely income on the making the right decision page.

As your State Pension is separate to your Fund benefits, the estimates you receive from us, won’t include details of your State Pension benefits.

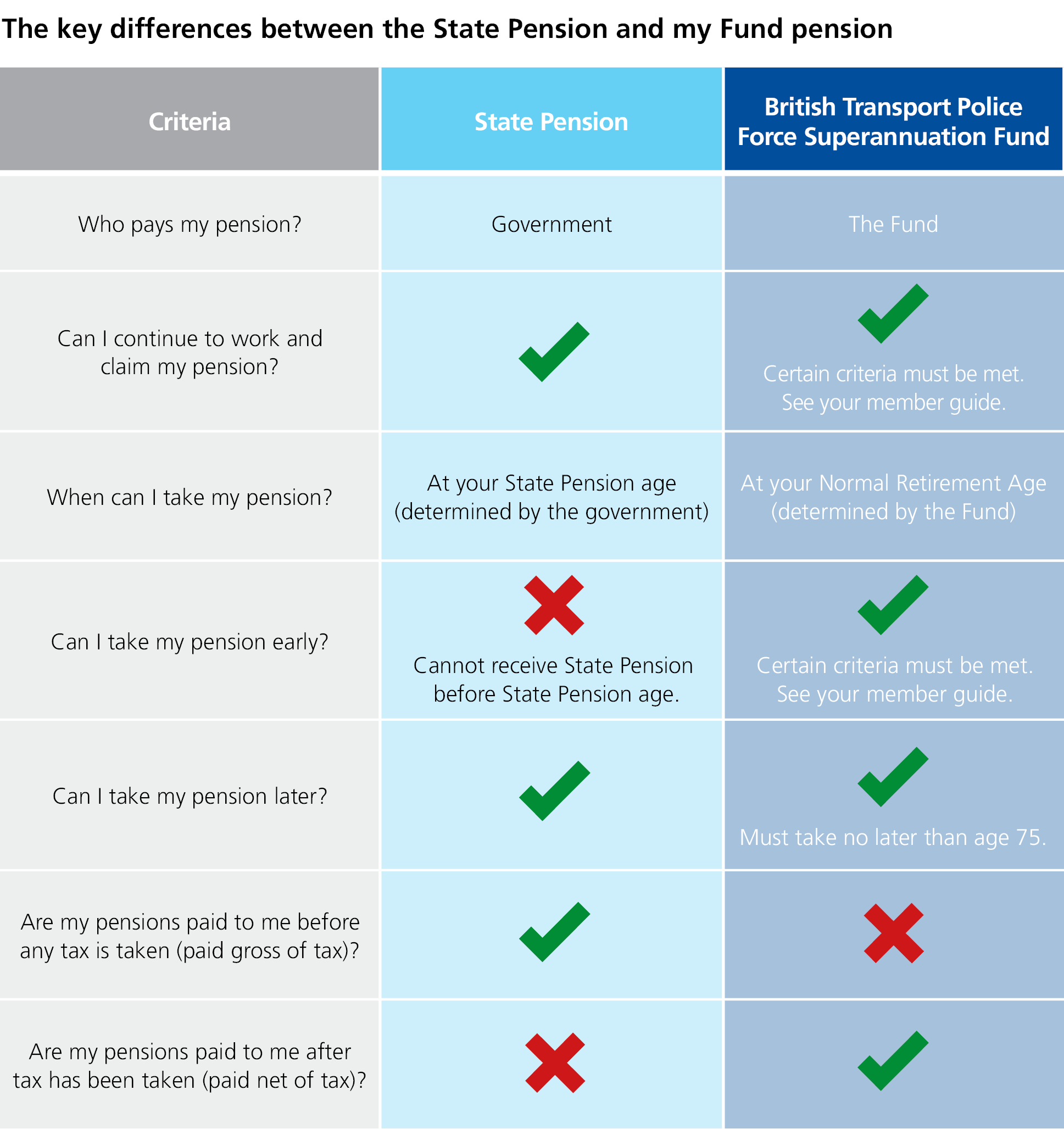

The rules of the State Pension are set by the Government and may be different to those for your Fund pension.

Find a summary of the key differences in the image.

If you pay Additional Voluntary Contributions (AVCs) such as BRASS or AVC Extra, the rules may depend on how you chose to take your Personal Retirement Account (PRA). You can read more on the taking my BRASS and taking AVC Extra pages.

You can also find more information in their Member Guide. You can find your guide when you log in to your myFund account.