Ways to take my pension

Discover the different ways you can take your DB pension. and choose what's right for you.

Select from the headings below to learn more about the different ways you can take your pension as a member of the Fund, along with a few things you might want to consider to help make the right choice for you.

Watch this short video for a run-through of the different ways you can take your Fund pension.

As a member of the 1970 Section of the Fund you have the options below when you come to claim to your pension.

However you can choose to either:

Take more lump sum and less pension

You can give up some of your annual pension to provide extra tax free cash. Giving up £1 of annual pension would provide an extra £13 lump sum. You are usually able to take up to 25% of the value of your benefits (but no more than £268,275) as a tax-free cash lump sum.

OR

Take less lump sum and more pension

You can use some or all of your lump sum to buy extra annual pension. Giving up £13 of lump sum buys £1 of annual pension. However, if you are in BRASS, you must take a lump sum at least equal to the value of your BRASS fund.

You do not have to choose the minimum or maximum – you can take a pension and lump sum anywhere in between.

.jpg?sfvrsn=7653dbf1_0)

You may want to take your Fund pension before you can claim your State Pension. If you do, you can choose whether to have a lower starting pension that increases when you reach your State Pension age, or a higher starting pension that reduces when you reach your State Pension age.

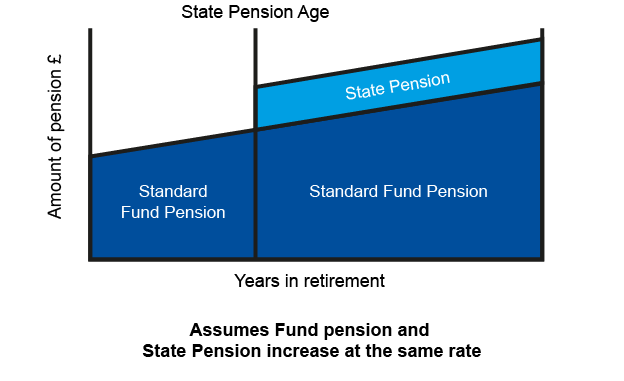

No Flexible Pension option

If you do not choose a Flexible Pension option, your Fund pension starts at its standard level and increases in line with inflation throughout your retirement as shown below:

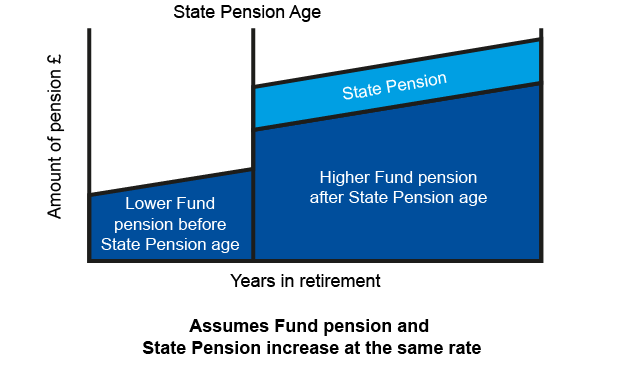

Flexible Pension option A

Flexible Pension option A provides a lower Fund pension when you retire, then a higher Fund pension when you reach State Pension age. This may be appropriate if you plan to take up another job when you take your benefits from the Fund.

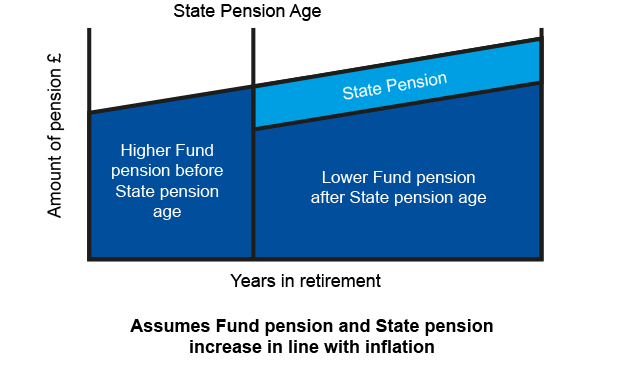

Flexible Pension option B

Flexible Pension option B provides a higher Fund pension when you retire, then a lower Fund pension when you reach State Pension age. This aims to smooth or level out your income throughout your retirement as shown in the diagram.

You can give up some of your pension to increase the amount of pension your named dependant would receive on your death.

The dependant’s pension is increased by 15% and how much yours is reduced by depends on the age and sex of you and your dependant.

If you choose this option and your dependant dies before you, the option cannot be undone.

Visit the my pension when I die page to read more about death benefits.

Your State Pension age is the earliest age you can start receiving your State Pension. It may be later than the age you can get a your Fund pension.

As a member of the 2007 Section of the Fund you have the options below when you come to claim to your pension.

However you can choose to use some of your lump sum to buy extra annual pension.

The cost of buying extra pension depends on your age and sex.

You can request an estimate of your benefits in your myFund account to see the maximum additional pension under this option and what effect it would have on your lump sum.

You do not have to choose the minimum or maximum – you can take a pension and lump sum anywhere in between.

As a member of the CARE Section of the Fund you do not earn a lump sum as well as a pension, but you can choose to give up some of your pension to provide a lump sum if you wish.

Log into your myFund account to request an estimate of your beneifts. An estimate is a forecast of your projected pension.

How much lump sum is provided by giving up £1 of pension depends on your age and sex.

The estimates Railpen provides will show you the maximum lump sum under this option and what effect it would have on your pension.

You do not have to choose the minimum or maximum – you can take a pension and lump sum anywhere in between.

If you decide to give up some of your pension for a cash lump sum, part of your pension will be paid to you in cash when you retire. The rest will be paid every four weeks thereafter.

If you don't want a lump sum, you'll take all of your benefits as regular pension payments.

There's more information on this in your Member Guide - get it by logging in to your myFund account. You'll find it under 'My Library'.

There are 2 Additional Voluntary Contributions (AVCs) arrangements within the Fund – BRASS and AVC Extra.

If you’re a 1970 section member, you may have saved extra towards your Fund pension with the BRASS AVC arrangement. If this is the case, your BRASS pot will be combined with your Fund benefits when you retire.

If you’re a member of the 2007 or CARE section, or if you are a 1970 section member and you have reached the BRASS contribution limit, you may have paid into AVC Extra. When you come to claim your pension, your AVC Extra benefits will not be combined with your Fund benefits. They will be paid to you separately.

Find out more about BRASS and AVC Extra in the saving more area of this website.