When to retire

Find out when you can start taking your Fund pension.

Use the options below to read more about the different times you can start taking your pension, as well as a couple of other things you might want to consider.

This is usually between 55 and 65 years old, depending on the section of the Fund you’re a member of and its Normal Retirement Age (NRA).

Once you’ve reached your NRA, you’ll get an income that is based primarily on your salary and membership.

There will be no reduction in the benefits you receive at normal retirement, unlike with other types of retirement, including some of those listed below.

Log into your myFund account to find your NRA. You can do this by:

Your NRA is likely to be different to the age for claiming your State Pension.

While your NRA is set by the Scheme, the State Pension Age is set by the government and is based entirely on when you were born. Read the State Pension page for more information.

Check your State Pension age at gov.uk.

You may be able to start taking your pension before you reach you Normal Retirement Age (NRA). This is known as early retirement and is usually allowed for members aged over 55.

It could also be possible to apply for your pension benefits from age 50 if you have a Protected Pension Age. You can read more about the Protected Pension Age by selecting 'How a Protected Pension Age affects you' from the contents list at the top of this page.

Log in to your myFund account to check your Member Guide.

If you decide to retire early, you will no longer be eligible for:

There are also extra restrictions if you want to take your pension early and continue working.

Check the staying in work page for details.

You may be able to continue paying into the Fund after your Normal Retirement Age (NRA), up to age 75. This means you will remain an active member.

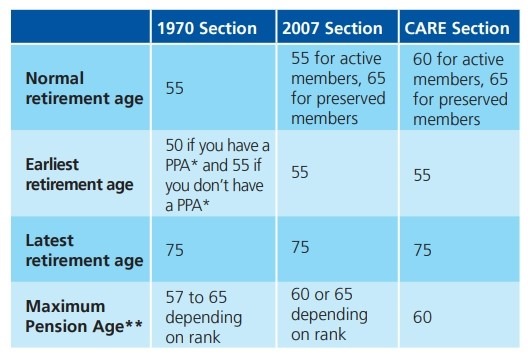

Depending on the Section of the Fund you’re member of, you may need to inform your employer if you wish to contribute past your Maximum Pension Age. See the table below.

*PPA – Protected Pension Age. If you were an active member of the Fund on 5 April 2006, you may have a Protected Pension Age of 50.

**Maximum Pension Age – the age at which you normally stop contributing and earning benefits, although there may be an option to continue.

As an active member you will continue to build your pension and will keep all the other benefits of being a member until you leave. Read more on the benefits of my membership pages:

If you decide to stop paying into the Fund before taking your pension, you will become a preserved member.

As a preserved member, you need to take your benefits at your normal retirement age OR, depending upon the rules of your Section, you may be able to opt to put off taking your pension, up to the age of 75.

In this case, late retirement factors (LRFs) will be applied to increase your benefits when you take them. That's because the Fund will likely be paying your pension for a shorter period of time.

Late retirement factors do not apply to active members and you can usually continue to build up benefits as long as you remain an active member. Please check your Member Guide for more details.

You can find your Member Guide in your myFund account.

If you leave work on or after your NRA, then your application to postpone taking your pension must be received by the Scheme administrator, Railpen, no later than three months after your leaving date. Visit the applying for my pension page for more details.

If you leave work before your NRA and are a preserved member, you can only apply to postpone taking your benefits within three months of your NRA (either three months before or three months after).

If you have to stop work due to ill health, then you may be able to start taking your pension before your Normal Retirement Age (NRA).

Unlike early retirement, ill health retirement does not result in any reduction being applied to your benefits.

To apply you must be under your Normal Retirement Age, have at least 5 years’ Fund membership and be leaving employment because of ill health.

You can find more information on the my circumstances have changes pages in the document below.

If you were an active member of the scheme on 5 April 2006, you may have a Protected Pension Age of 50. This means you will be able to take your pension as early as 50 years old, rather than 55.

This does not apply if you have:

A Protected Pension Age of 50 (PPA 50) only applies to members of the 1970 section. If you have a PPA50 and take your pension before age 55, there are certain restrictions that apply:

If you do not follow these restrictions then you could face a big tax bill of up to 55% on any benefits you take up to age 55.

Please contact us directly for more information about your options for taking your benefits with a Protected Pension Age (PPA), and the timescales involved. If you're already planning your retirement, you need to get in touch straight away.

You can find more general information about PPA in the guide on Protected Pension Age. This is currently being updated to give you more details on all of the restrictions around taking your benefits outlined above.

Here's where you can find more information if you're thinking about when to retire...

If you’re unsure which type of retirement will be best for you, you may want to get expert help. Find out more on the guidance and advice page.

Use the steps on the making the right decision page to take stock of your pension to help work out what's best for you.

If you're not ready to retire then you may still be able to keep working and start taking your pension. Find out more on the staying in work page.